NFT and DeFi will take over the world, and we won't even know what it is.

Diving into trends with Joseph Marc Blumenthal

2008 saw a notable revolutionary intervention in the technology world with the help of blockchain. Satoshi Nakamoto laid the foundations for the electronic money system and paved the way for many revolutionary blockchain technologies in various sectors. In the early years, blockchain mainly focused on cryptocurrency applications , and has gradually evolved into programmable money that can be adapted for hundreds of different uses. And now, almost 13 years later, the blockchain system has transformed into a complex ecosystem of many components.

Today we will look in detail:

● What does the blockchain ecosystem consist of now?

● An advanced look at derivatives of blockchain infrastructure. DeFi

● An advanced look at derivatives of blockchain infrastructure. NFT

● Briefly about the economy and cryptocurrency in 2021

● What will happen next?

What does the blockchain ecosystem consist of now?

● Exchanges (exchanges / exchanges) - provide a springboard for listings of all kinds of tokens, as well as swap services, liquidity provision, P2P exchange, and so on;

● Wallet (wallets) - tools for storing digital assets;

● Blockchain Platform (networks) - the main layers on top of which economies are built and applications are written, as well as on the basis of which the above tools exist;

● Stablecoin (stable) - a number of large and widely recognized coins and tokens (USDT, USDC, DAI), pegged to $1 and therefore devoid of risks associated with volatility;

● Tooling - utilities and trackers that market participants used to track rates and other market movements;

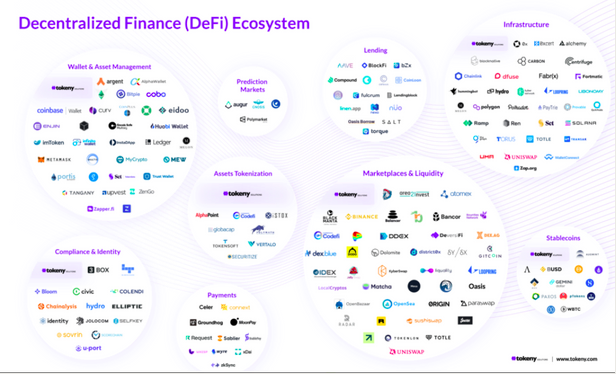

● DeFi (decentralized finance) - a layer of public financial applications (dApp's) in the Ethereum network that interact with each other and do not have a central leadership (node), state affiliation and geographic restrictions;

● Gaming + NFT (gaming and non-fungible tokens) are tools and applications that are related to GameFi or NFT industries: play-2-earn games, NFT marketplaces, game economy tools and metauniverses.

An advanced look at derivatives of blockchain infrastructure. DeFi

There is a "competition" on the wallet market: who will be the first to create a multi-chain wallet that will allow cheap transactions between blockchains without using bridges (bridges) and without moving funds through additional layers of the network;

● The Payments section represents payment systems and the aforementioned

additional "cheaper" layers of the Ethereum network. These projects are working to introduce digital assets as means of payment and improve UX in the current low bandwidth environment;

● In the Lending section, everything is pretty static: you give a collateral, you get more credit for it, and you farm. Or you provide liquidity to the protocol and earn% from commissions.

● In the Stablecoins section, active work is carried out around the creation of new algorithmic stablecoins. This is seen by market participants as the optimal strategy to get rid of attachment to fiat currencies and centralized stable, because the price of algorithms is regulated by an algorithm (smart contract) and crypto-assets of collateral, instead of being pegged to the price of the US dollar;

● In the Infrastructure section , where networks and solutions for their scalability are mainly located

, fundamental problems of network hashrate are solved, issues of environmental friendliness of consensus (PoS vs PoW) are raised, databases, resource-intensive methods of storing information, etc. are studied;

● The Prediction Markets section is exchange instruments created for trading the results of events, futures. Market prices can indicate the mood of the community about an event;

● The Assets Tokenization section is responsible for data and property tokenization. That is, for the transfer of information or objects to the digital property format (NFT is one of the possible digital property formats, and it can be anything, not just art objects).

An advanced look at derivatives of blockchain infrastructure. NFT

The NFT infrastructure is not as simple as it might seem at first glance. From the unobvious: it is very fashionable now to have a "domain name" (ex. Acidpunch.eth), so domain services are now evolving. The domain name can serve as a representative tool in the community.

The NFT fashion segment is represented by organizations that produce their own collections of clothing and accessories or merchandise. The funny thing is that the clothes are usually themed:

The Infrastructure section reflects the networks on top of which everything is built. Virtual worlds are anything related to the meta universes . Large IT players are already actively investing in this area, for example, Facebook (google the $ MVI index if interested). The showcases and the audio section are small and narrowly targeted offshoots that host virtual exhibitions in the aforementioned meta-universes, and develop the direction of music as a digital property.

NFT architecture

It would be logical to start with the "first layer", which is represented by the systems and networks on which the infrastructure is built. The most popular of them are Ethereum and Solana . Near and other networks are not much, but they are lagging behind due to the difference in monetary volumes.

They are followed by L2 solutions , that is, sidechains that neutralize expensive commissions and partly solve the bandwidth problem. Further in the structure are peer-to-peer open source file systems , they are used to store data. Then, two sections of the ecosystem applications are superimposed on them, which, in turn, are divided into games, sports applications, metaverse and other virtual spaces.

And the “header” of the architecture is the interfaces , thanks to which we track our assets, study dashboards with volumes and also make swaps and deposits, because many trackers have exchange functions.

An example of a new direction of development in the NFT sphere is collective ownership and fractionalization of tokens. Many tokens cost a lot of money, so the community got the logical idea to buy them together and figure out how to get a collective profit from this. One example of implementation is the Fractional platform, where thousands of NFTs are collectively sold live. Then there is the Crowd Protocol, which won the recent Definition hackathon. They have not yet gotten their hands on implementation, but you can try to find their pitch deck on the Internet.

Comments

Post a Comment