Reasons for the deficit and rising inflation

Based on research by Bridgewater Associates.

Supply chain problems and rising inflation persist. For investors, inflation is a big risk. Markets view inflation as a temporary phenomenon: " ...inflation will return to central bank targets. Regulators will be able to use loose monetary policy for a long time. "

Bridgewater Associates researchers disagree.

"Newspaper headlines focus on local supply-side problems (the port in Los Angeles, coal in China, natural gas in Europe, semiconductors around the world, truck drivers in the UK, etc.) and miss a global cause for which there is not yet specific solution.

...current inflation and rising prices are not a pandemic-related supply problem. The supply of virtually everything has reached record levels. The reason is an upward demand shock due to the direct issuance of money to buyers of goods and services. Some inflation drivers are temporary, but the underlying supply/demand imbalance is worsening."

Researchers note a sharp increase in demand and a strain on the supply side to meet this demand almost everywhere. There is a lack of raw materials, energy, production capacity, stocks, housing and workers. Eliminating shortages in one area will obviously exacerbate the problem in other parts of the supply chain.

Production exceeds pre-pandemic levels

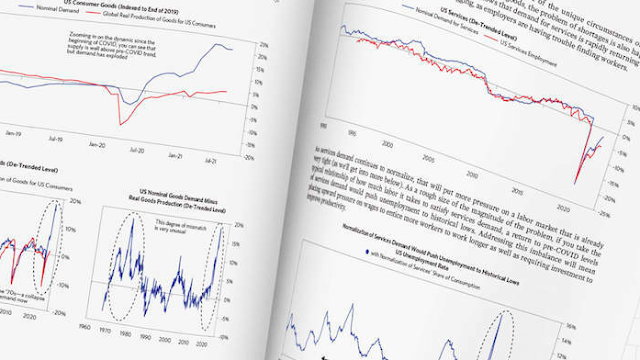

The offer recovered incredibly quickly. Real production of goods is now higher than before the crisis. The problem is that demand "exploded", creating an imbalance. Demand and supply are growing. But supply has not kept pace with demand.

Growing service gap

The imbalance between supply and demand in services will probably increase. Demand for services is rapidly returning to pre-COVID levels. Service supply and employment is lagging behind as employers struggle to find workers.

A return in demand for services to pre-COVID levels would drive unemployment to historic lows. Correcting the imbalance will require higher wages to attract more workers and investment to increase productivity.

Reducing the deficit - a game of tic-tac-toe

You can solve the problem in one place, but it arises in another. To radically correct the situation you need:

- large investment in production

- and/or significant performance improvements.

Apparently the gap between supply and demand will be long due to the magnitude of demand and the ongoing expansionary monetary policy.

Governments have transferred huge amounts of cash to households. Household balance sheets are now in better shape than they were before the pandemic. Helicopter money has increased the value of stocks, housing, cryptocurrencies, etc. Stimulus financing has lowered debt service costs, and household incomes have risen as the economy recovers. The willingness of households to spend creates the basis for a sustained increase in demand.

To slow down price growth, you need:

- A significant increase in labor productivity so that supply can catch up with demand.

- Tighter monetary and monetary policies of governments to reduce demand.

Examples of shortages and rising prices

- Shortage of commodities. Metal prices have risen sharply since last year as demand far outstripped supply. Supply for copper, aluminum and nickel is higher than in recent years. But prices are still rising and stocks are shrinking.

- There is not enough energy at the current level of demand to support economic activity. Prices for natural gas, coal and oil are rising around the world.

- Lack of production capacity . Most of the production capacity is located in China. Now production in China is 20% higher and exports are as much as 40% higher than at the beginning of 2020. That's why China's energy crisis - huge global demand has created a need for energy.

- Insufficient inventory of goods or capacity to ship . Inventories across all sectors of the economy fell to historically low levels. And it is much more difficult for companies to obtain the resources necessary for production. The cost and terms of various types of deliveries have increased significantly.

- Lack of residential real estate . Low real interest rates and rising wages support strong demand, but supply has not kept pace. Prices have been raised everywhere due to monetary stimulus.

- Not enough workforce. 50% of all companies in the US are unable to fill vacancies. The level of dismissals at the request of the employee is the highest in the history of measurements. Wages are rising as the demand for employees far outstrips the supply of labor. Researchers believe that wage growth is just the beginning of the next wave of inflationary pressure.

Comments

Post a Comment